- #BHAAG MILKHA BHAAG TORRENT HOW TO#

- #BHAAG MILKHA BHAAG TORRENT FULL#

- #BHAAG MILKHA BHAAG TORRENT REGISTRATION#

- #BHAAG MILKHA BHAAG TORRENT CODE#

- #BHAAG MILKHA BHAAG TORRENT PASSWORD#

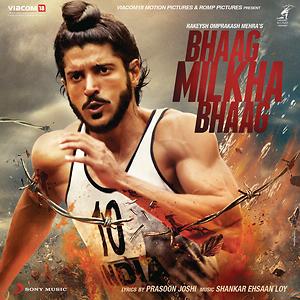

please do not register more than one time.Bhaag Milkha Bhaag ( transl.

#BHAAG MILKHA BHAAG TORRENT PASSWORD#

In the Last screen enter the preferred user id and password details for your one time account, you will receive a SMS with the user id and other details of your keralapsc account. In the next step you should fill out the contact details such as address ,mobile number and e-mail address.ĥ.

#BHAAG MILKHA BHAAG TORRENT FULL#

Enter The full Details like Your Identification Marks, Native, nationality, residing district, taluk, village etc.click next button to Continue.Ĥ. Next Step is to fill out personal details of the candidate such as Name (Full Name including last Name)gender, date of birth, relegion,caste, sub caste etc… FIll the details accurately and click the next button to continue to next step.ģ. Upload a Scanned signature of size of 150px*100px and the size should below 30 KB. with name and date of photo was taken at bottom of the photo (Note :photo must taken within / less than 6 months). You must upload a photo size of 150px * 200px it must be below 30 KB in size. Instructions to register for One TIme in Website

#BHAAG MILKHA BHAAG TORRENT REGISTRATION#

WHAT IS KERALAPSC ONE TIME REGISTRATION READ HERE

#BHAAG MILKHA BHAAG TORRENT HOW TO#

HOW TO REGISTER FOR KERALAPSC ONE TIME REGISTRATION - INSTRUCTIONS

#BHAAG MILKHA BHAAG TORRENT CODE#

Labels: Income Tax, income tax return, What is Portuguese Civil Code Tags: What is the Portuguese Civil Code, tax returns, what is the Portuguese Civil Code Wage income is not the only person to win the bride and groom as well as income apportioned.

(2) If the husband or, as it may be, the wife governed by the system of social property income under the head if According to the Portuguese Civil Code are all personal income in the form of income tax from wages unless the employer. Under the Income Tax Act, § 5a 1 [consume at least between spouses governed by Portuguese Civil Code (1) If a husband and wife are the property of the company (as in 1860 known under the Portuguese Civil Code "COMMUNIAO DOS Bens") applicable in the state of Goa and the Union territory of Dadra and Nagar Haveli Daman and Diu controls, and husband and wife, chief income no income It is not like common property (an association of persons or body of persons, whether or not refined) as a high-priced, but the reception as husband and wife, each head of income (other than the head "salaries" than under) the same man and wife, and therefore the revenue split between revenue husband and wife, respectively, will be divided, and the other provisions of this Act shall apply mutatis mutandis. Therefore, the income of each spouse income allocated to each spouse separately and only his / her share of the profits and the profit and loss account is necessary. According to the Portuguese Civil Code, any income of the husband and wife from all sources (with the exception of wage employment income) derived from the same shall be divided between the spouses. However, in this case you will be governed by the laws of any of these sites, you will need to select "Yes". If not, governed by the laws of those places, select "No", you must at this point. India's civil code only Portuguese Goa and Dadra and Nagar Haveli and Daman and DUI in the state of the Union. What is Portuguese Civil Code mentioned in Income Tax Return? Portuguese Civil Code - What is Portuguese Civil Code mentioned in Indian Income Tax Return? Investment Data / HRA details are included in the form of the 16th Step 2) E-mail your details information required for filing tax returns are:ĭocuments required for filing tax returnsįorm 16 / or salary certificate and details of other income, if any. Personal attention to each guest and return an Certified Accountants Hassle-free return filing, just upload form 16 payment and relax, we will do all the calculations and cumbersome file ITR forms for you. Unpaid Individuals who are self-employed as free of external collaborators, consultants, sole proprietorship businesses.Īdvantages of filing a tax return with us: We provide tax advice comeback Online application. Studycafe.in provides a simple and convenient return filing / online return filing experience. How Efile income tax returns and paid for Professionals How to eFile Income tax Return for Salaried Persons and Professionals.

0 kommentar(er)

0 kommentar(er)